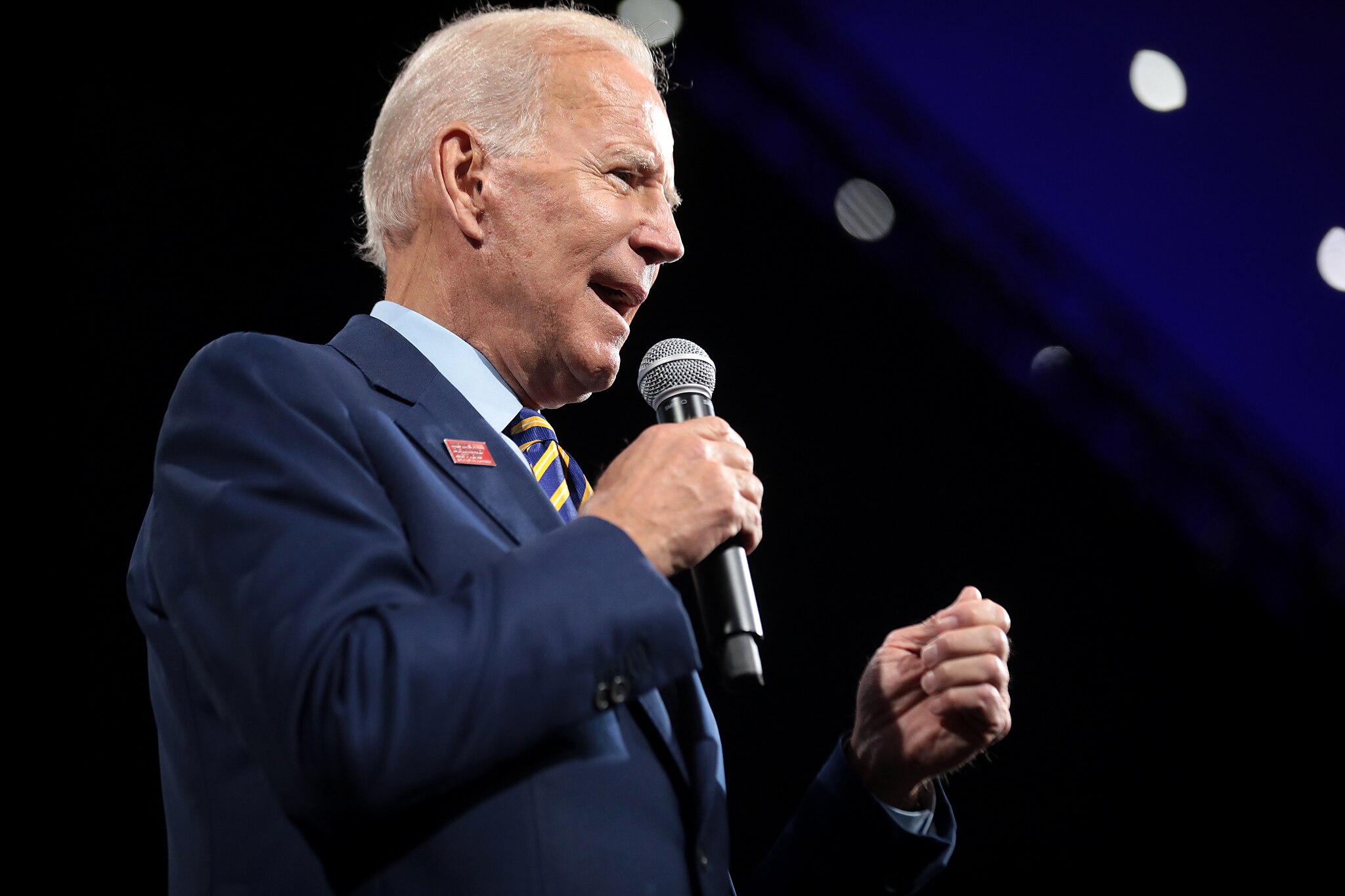

Bumbling Biden is going so far-left that he’s sabotaging his own climate agenda.

The White House has revealed eagerly awaited guidelines, outlining substantial restrictions on the eligibility criteria for federal tax credits in the field of hydrogen power. Released jointly by the White House, Treasury Department, and Department of Energy on Friday, these guidelines, tied to the 2022 Inflation Reduction Act (IRA), connect the highest production credit of $3 per kilogram of hydrogen to stringent green energy standards.

While the restrictions gained support from environmentalists and select green energy companies, opposition emerged from business and clean power industry groups. John Podesta, President Biden’s clean energy czar, highlighted the IRA’s hydrogen tax credit as a crucial driver for establishing a clean hydrogen industry, particularly in sectors challenging to decarbonize, such as heavy industry and transportation.

Energy Secretary Jennifer Granholm underscored the unprecedented investments and the goal of leading the global clean energy transition through hydrogen development. Hydrogen is seen as pivotal for mitigating future greenhouse gas emissions, particularly in hard-to-decarbonize sectors such as shipping, heavy trucking, and cement and steel manufacturing, which collectively contribute nearly 60% of U.S. end-use emissions.

The hydrogen production tax credits, valued at up to $100 billion, were established under the IRA, a comprehensive climate and tax legislation signed by President Biden in August 2022. However, the formulation of these credits has sparked intense debate due to concerns about potential carbon emissions during hydrogen production, causing delays in releasing the guidance.

The proposed regulations outline a 10-year availability period for credits, starting when a hydrogen production facility is operational for projects commencing construction before 2033. The IRA comprises four credit tiers based on carbon intensity, ranging from $0.60 to $3 per kilogram.

A key aspect of the guidelines is the requirement for hydrogen producers to qualify for the highest tax credit only if electricity comes from a green energy source operational within three years of a new facility’s service date. Additionally, starting in 2028, hydrogen developers must source electricity on an hourly basis from clean energy, with strict regional sourcing conditions.

While environmentalists welcome these rules for promoting clean hydrogen production, industry groups and hydrogen companies argue that the stringent regulations will hinder investment, increase hydrogen costs, and discriminate against existing low-carbon power sources. Congressional opposition, including from Senate Democrats, is also anticipated, as some argue for a more gradual phase-in of stringent guidance to allow for industry growth and job creation in the clean hydrogen sector.

The strictness of Biden’s hydrogen policy has raised concerns that it might inadvertently hinder his own climate agenda. Critics argue that such stringent measures could impede investment, increase costs, and discourage projects in the clean hydrogen sector, potentially undermining the broader goals of the Biden administration in combating climate change. Striking a balance between environmental objectives and the economic viability of emerging industries remains a challenge for policymakers.